are hoa fees tax deductible in california

In California the average home sells for 600000 to 700000. One question many homeowners ask is whether or not they can claim assessment fees on their taxes.

Hoa Taxes Examining The Differences Between Form 1120 H And 1120

Closing costs arent just the fees youll pay to a closing agent.

. Population overall was approximately 325 million with 53 million persons 65 years of age and over covered by the federal Medicare program. Average closing costs in California. These charges cover your inspection appraisal and origination costs as well as title insurance and courier fees.

Get the latest headlines on Wall Street and international economies money news personal finance the stock market indexes including Dow Jones NASDAQ and more. Heres How To Lower HOA Fees. There are two ways to approach vehicletravel deductions.

And letter supplies are tax-deductible. The recovery period differs based on the type of improvement. We would like to show you a description here but the site wont allow us.

On Form 4562 enter the annual depreciation as a separate line item on line 19h for residential properties or line 19i for commercial properties. Support RFSC Donate Ralphs Reward Program. Welcome to Retrievers Friends of Southern California Inc.

Simple Spreadsheet for Rental Property Analysis. If you perform remodeling or other improvements include those on Form 4563 Depreciation in Part III. Homes have some predictable ongoing costs including a monthly mortgage payment property taxes property insurance and an HOA if applicable.

Every county in California has a transfer tax. In other cases the HOAs policy may have a high deductible. Your tax-deductible donations are appreciated.

Consult IRS Publication 946 How to Depreciate Property for specifics. To illustrate how a rental property analysis works in the real world weve put together a. For extensive remodeling using different recovery periods consider consulting a tax accountant.

For instance in California. So if your house sells for 1000000 and your property is not located in San Francisco County then the county transfer tax would be 1100. Homeowners association HOA fees.

San Franciscos transfer fees or taxes operate under its own unique calculation. In a word yes. For the rental portion expenses including mortgage interest property tax insurance maintenance repairs improvements utilities management and even depreciation are deductible to the extent they exceed rental income but the deduction cannot be taken against all types of income and in some cases must be carried forward and.

A capital improvement is the addition of a permanent structural change or the restoration of some aspect of a property that will either enhance the propertys overall value. During 2016 the US. Travel and vehicle expenses.

Be informed and get ahead with. If your rental properties belong to a homeowners association then you are responsible for paying dues. Health insurance coverage is provided by several public and private sources in the United States.

The 272 million non-institutional persons under age 65 either obtained their coverage from employer-based 155 million or non. Best Tax Software Best Tax Software For The Self-Employed 2021-2022. Latest news and advice on mortgage loans and home financing.

And tax deductible travel expenses for long distance real estate investors. Homeowners association HOA fees. If you find a property within that price range expect to pay between 6120 and 7140 before taxes in closing costs.

Keep track of your mileage when using your vehicle for. These may also include the costs incurred throughout the experience of originating the loan and buying your home. Part of these fees goes to pay the HOAs master insurance policy.

But sometimes damages exceed the limits of that policy. If you paid 6000 a year in property tax on your duplex and paid 31000 in mortgage interest you would claim 15500 as a personal deduction on Schedule A for interest and claim 3000 worth of. Are HOA Assessments Tax Deductible.

An economics professor at the University of California-Irvine. Most condo owners pay monthly fees to their HOA. Owning a house that is part of a homeowners association also means paying an HOA fee usually once a month.

100 of all adoption fees and donations are used for the care of the dogs in our program. RFSC We are. 13 Legal Rights Of Homeowners In HOA Communities And FAQs.

Are Hoa Fees Tax Deductible Here S What You Need To Know

Are Hoa Fees Tax Deductible Here S What You Need To Know

Can I Write Off Hoa Fees On My Taxes

Can I Write Off Hoa Fees On My Taxes

Are Homeowners Association Fees Tax Deductible

Are Hoa Fees Tax Deductible Here S What You Need To Know

How To Sell Your Home When Your Hoa Is Involved In A Lawsuit To Read More On This Click Here Or Go To Https Loom Ly In Law Suite Homeowner Real Estate News

Closing Costs That Are And Aren T Tax Deductible Lendingtree

Are Hoa Fees Tax Deductible Here S What You Need To Know

How Electric Vehicle Tax Credits Work

Are Hoa Fees Tax Deductible Clark Simson Miller

Are Hoa Fees Tax Deductible Clark Simson Miller

![]()

How To Sell Your Home When Your Hoa Is Involved In A Lawsuit To Read More On This Click Here Or Go To Https Loom Ly In Law Suite Homeowner Real Estate News

![]()

How To Sell Your Home When Your Hoa Is Involved In A Lawsuit To Read More On This Click Here Or Go To Https Loom Ly In Law Suite Homeowner Real Estate News

Do Hoa Pay Taxes Everything To Know About Hoa Taxes Hoam

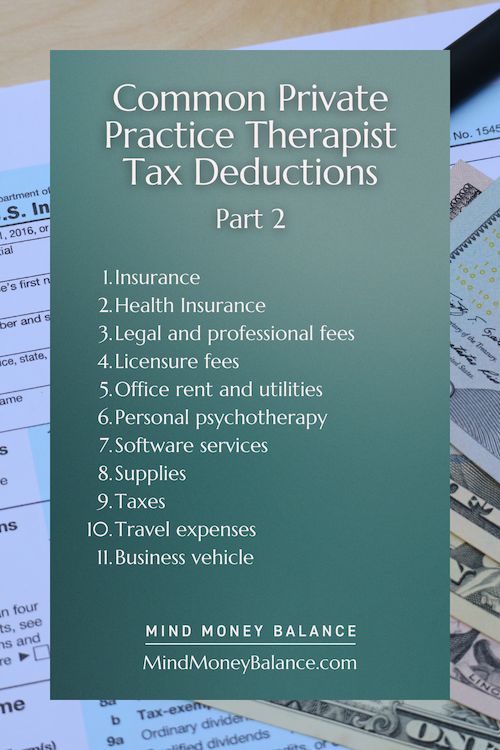

Tax Deductions For Therapists 15 Write Offs You Might Have Missed

Can I Write Off Hoa Fees On My Taxes