rhode island state tax id number

In either case we. You need to choose the tax and legal structure of the business.

Free Rhode Island Notice Of Termination Of Tenancy Pdf Word Template Professional Reference Letter Resignation Letter Template Free Letter Templates Free

Rhode Island Unemployment Insurance Account Number and Tax Rate.

. Individual Taxpayer Identification Number ITIN. The extra 600week the extra 300week and the extra 200week are all included in this amount. One of several steps most businesses will need to take when starting a business in Rhode Island is to register for an Employer Identification Number EIN and Rhode Island state tax ID numbers.

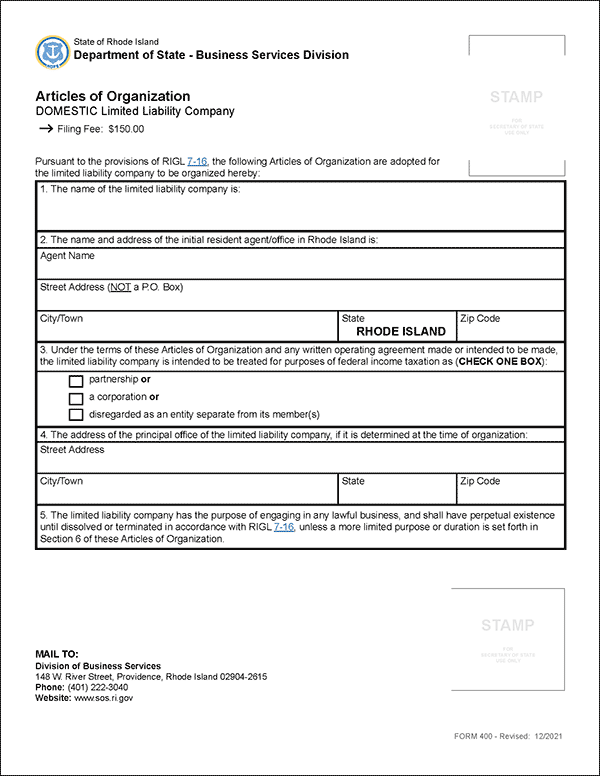

Search by Filing Number Must be 12 digits. Many business owners find it is much simpler to use Govt Assist LLC to secure a tax ID number. Employees Withholding Certificate Form 941.

RI Employer Account Number if available 10 Digits including leading zeroes RI Tax ID. Small Business Events in Your Area. To protect your data you will need a Personal Identification Number PIN to link your account.

Find your Florida Tax ID Number Folio Number Parcel ID Number Tax ID. THERE ARE 4 RI NUMBERS. GovDocFiling Eliminates the Guesswork in Obtaining a Tax ID Number.

As such most companies keep their tax ID numbers private so you probably wont find it published on the companys website. The 1099-G also includes all federal and state unemployment boosts which are also taxable income. RI State Employer Tax ID Number.

There are two Cranston business tax ids. File for Rhode Island EIN. Employers also need a state employer tax number and a federal tax.

If you are a new business register online with the RI Division of. Sales RI State Tax ID Number Sellers Permit Federal Employer Tax ID Number. If the customer is the State of Rhode Island a RI municipality or the Federal Government the sale is exempt and no certificate is required.

The application process for getting a state tax ID number in Rhode Island isnt much different than the process for applying for a federal tax ID number even though theyre managed at different governmental levels. It should also be noted that individuals who purchase taxable goods services for their personal use without paying Rhode Island tax should also pay use tax to the State by filing a Consumers Use. However many documents require the number.

Things can be complicated but use our service and we. At Govt Assist LLC we make the process as easy as possible. Rhode Island Public records.

2022 Filing Season FAQs - February 1 2022. The ocean State Rhode Island official website. Then there is a business license number that you get and it is essentially another Rhode Island tax ID number.

Uses of Rhode Island Tax ID EIN Numbers. Find your Rhode Island property tax ID parcel ID. Search by Identification Number Must be 9 digits.

A state ein and a state sales tax id. Do I need a Rhode Island federal tax id number. First youll need to have a federal tax ID in place which you can get in less than an hour via the online application.

By allowing GovDocFiling to assist you with applying for Rhode Island tax ID number you can eliminate any risk of long delays or incorrect submissions which could jeopardize the hard work youve put into your business. A state tax id can be a state tax id employer number or a wholesale Rhode Island tax ID number. If you are interested in using the Portal and have not already received a PIN letter in the mail you may request a PIN by contacting the Rhode Island Division of Taxation via phone 4015748484 or email taxportaltaxrigov.

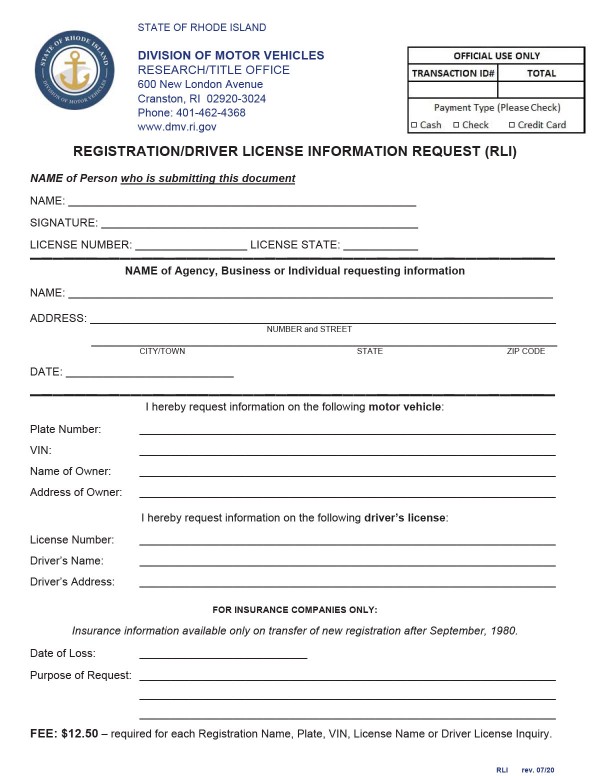

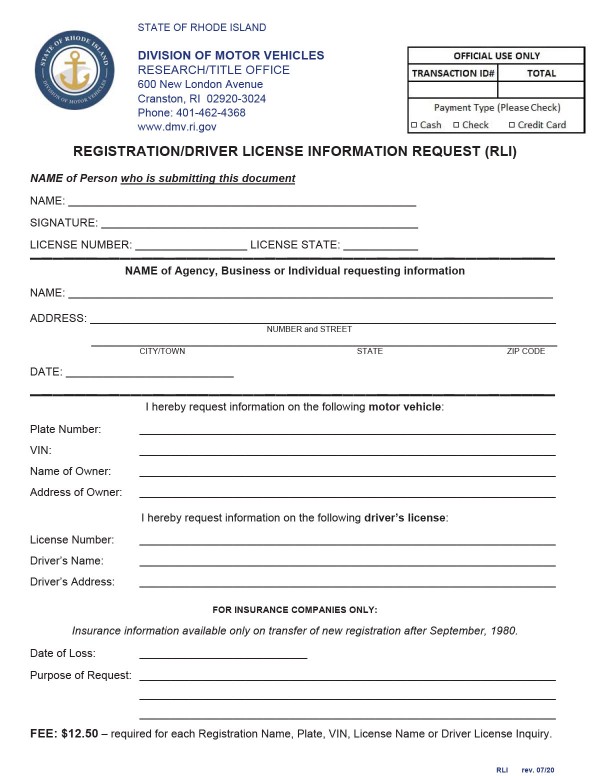

The Rhode Island DMV does not accept an ITIN as a form of identity. It can be a sole proprietor a partnership or an LLC or Corporation. Request for Taxpayer Identification Number TIN and Certification Form 4506-T.

Please have your reference number and tax ID number ready. The Division of Taxation allows for online registration for a new business. You must have a valid social security number or an acceptable denial letter from Social Security with an acceptable visa code.

The you need to obtain the permits and tax IDs for the state of Rhode Island. Obtaining a Rhode Island Tax ID EIN is a process that most businesses Trusts Estates Non-Profits and Church organizations need to complete. State of Rhode Island.

If you already have a Rhode Island Withholding Account Number you can find it on previous correspondence from the RI Department of Revenue or by contacting the agency at 401-574-8829. Employers Quarterly Federal Tax Return. These numbers are most commonly used to register a business with the federal and state government in order to pay sales taxes payroll taxes and withhold taxes from.

Does the State of Rhode Island initiate or automatically deduct the payments. If youre an independent contractor you can find this number in the Payers Federal Identification. A Rhode Island tax ID number is a business tax id and also a federal employer number.

2022 IFTA Return Filing Guidance - April 26 2022. GovDocFiling makes it easy on you. Even for businesses and entities that are not required to obtain a Tax ID EIN in Rhode Island obtaining is suggested as it can help protect the personal information of the individuals by.

To get a Rhode Island tax ID number you need to apply to the IRS. If you still believe the 1099-G does not reflect the correct amount you may call the UI Call Center at 401 415-6772 to confirm the information. This application may be used to register your business for the following.

Tax ID for Ebay Home Business business in Chepachet RI Registration. Latest Tax News. If youre an employee of a company look in box B on your W-2 statement.

What number do I call if I have a question. Beycome logo blog - Real Estate Tips Trends Data for buyer renter and Homeowners. This fully interactive service allows you to register your business and pay associated registration fees with your credit card.

Rhode Island State Website. Doing Business in the State. Ebay Home Business Tax ID Registration in Chepachet RI Retail Trade LLC For An Ebay Business.

Rhode Island sales tax is collected with a sales tax id number to be paid to the state. Permit to make sales at retail. Office of the Governor Secretary of State RIgov Elected Officials State Agencies A-Z State Careers.

PPP loan forgiveness - forms FAQs guidance. However as with anything dealing with this agency the process can be quite confusing. Business Services Division Rhode Island Department of State.

RI Business Tax Registration ID Business License Question. Request for Transcript of Tax Return Form W-4. You may call 401-574-8484.

Search by a Business Address. Individual Tax Return.

About The Office Rhode Island Office Of The General Treasurer

Rhode Island Department Of Human Services Facebook

Find Craft Shows In Rhode Island 2019 2020 Festivalnet Com Island Crafts Island Crafts

Rhode Island Llc How To Start An Llc In Rhode Island Truic

Rhode Island Llc How To Start An Llc In Rhode Island Truic

Rhode Island State Tax Information Support

Rhode Island Notice Of Deficiency Letter Sample 1

Rhode Island Sales Tax Small Business Guide Truic

Rhode Island Notice Of Deficiency Letter Sample 1

All About Bills Of Sale In Rhode Island Facts You Need In 2020

This Is Our Fake Novelty State Rhode Island Id Sample Visit Http Www Theidman Com To View All Our Ids Or Http Www Face Magnetic Card Novelty Rhode Island

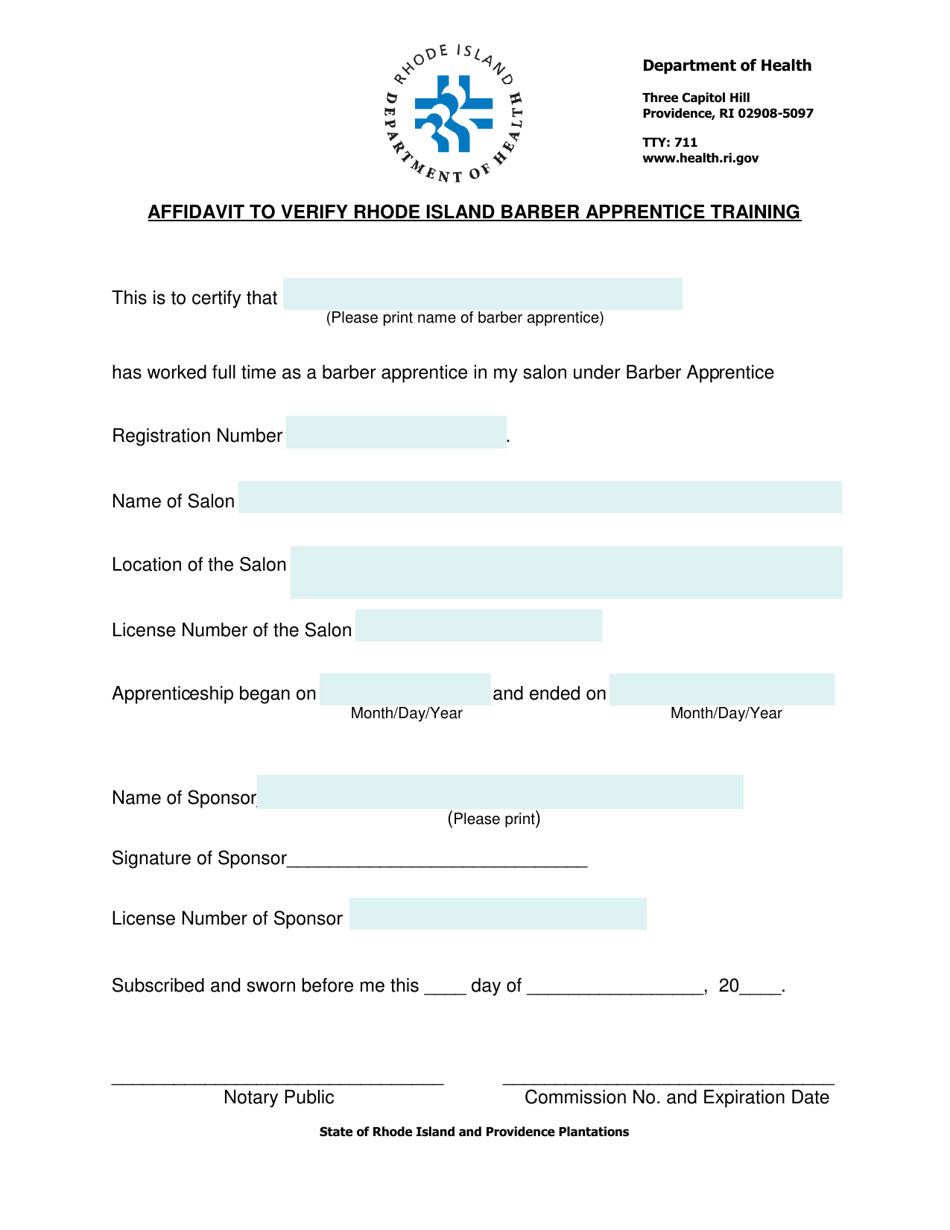

Rhode Island Affidavit To Verify Rhode Island Barber Apprentice Training Download Fillable Pdf Templateroller

Covid 19 Information Ri Division Of Taxation

State Of Rhode Island Linkedin

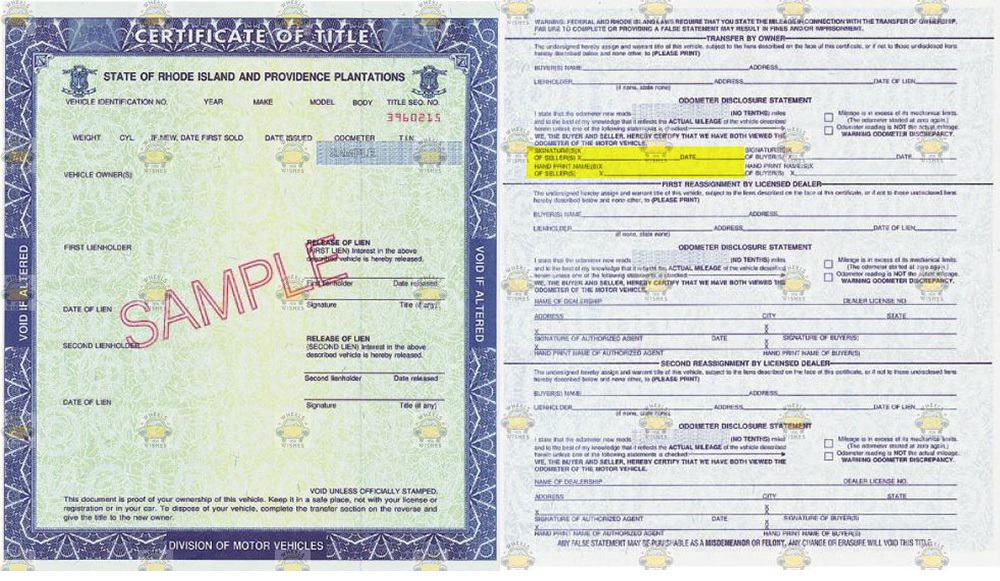

Title Questions For Rhode Island Vehicle Donations

Rhode Island Tax Id Ein Number Application Manual Business Help Center

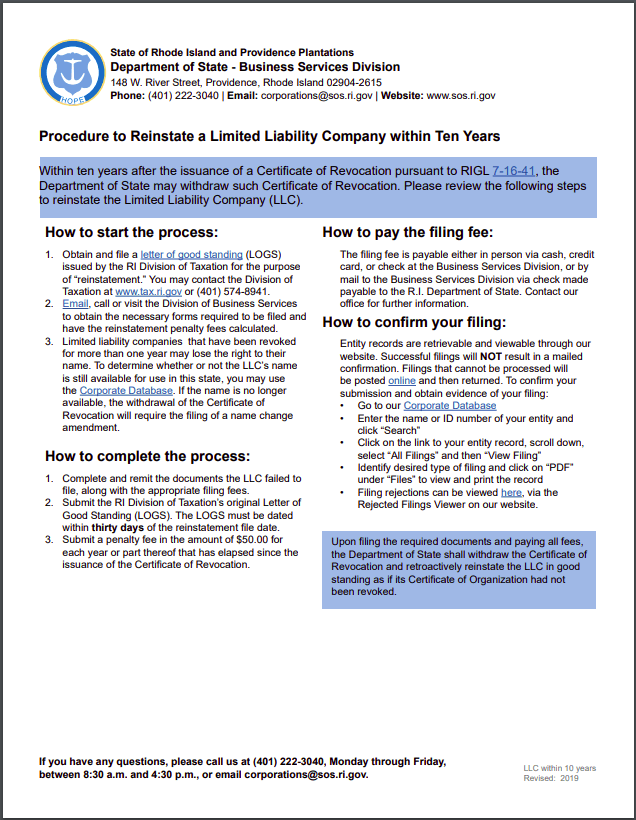

Free Guide To Reinstate Or Revive A Rhode Island Limited Liability Company