are nursing home expenses tax deductible in canada

You can also invest your money and gain higher. Earned income tax credit.

Medical Expense Tax Deduction Medical Tax Deductions

Minimum requirements for the dollar.

. Access to tax advice and Expert Review the ability to have a Tax Expert review andor sign your tax return is included with TurboTax Live or as an upgrade from another version and available through December 31 2022. The tax code allows tax-free stipends for all ordinary and necessary expenses incurred while working away from ones tax home. They follow a plan designed by the agency.

The medical expense tax credit is one of the most overlooked non-refundable tax deductions. Optical scanners or similar devices designed to allow a person who is blind to read print prescription needed. The purpose of the 50 reduction is to.

The Tax Counseling for the Elderly TCE program offers free tax help for all taxpayers particularly those who are 60 years of age and older. Your gain is actually your homes selling price minus deductible closing costs selling costs and your tax basis in the property. The costs of qualified long-term care including nursing home care are deductible as medical expenses.

In your Schedule 1 tax return you will find two areas where you can claim METC for CRA deductible medical expenses. Nursing home see Attendant care and care in a facility. According to the IRS the following entertainment related business expenses are still deductible.

Paid energy costs while living on a reserve. Health insurance premiums and prescription drugs and nursing care etc. For example to receive the OTB in 2022 July 2021-June 2022 payment period you must have filed your income tax return.

Qualified long-term care services are necessary diagnostic preventive therapeutic curing treating mitigating rehabilitative services and maintenance or personal-care services required by a chronically ill individual provided under a plan of care presented by a licensed. Which nursing home costs are tax deductible. Therefore whether or not traveling nurses qualify to receive tax-free stipends depends on where theyre working versus where their tax home is.

From the 201112 income year onwards you cant claim a deduction for self-education and study expenses you incur if you only receive a qualifying Australian Government allowance or payment. In 2020 your adjusted gross income AGI will be 5 higher than it is now. Your basis is the original purchase price plus purchase expenses plus the cost of capital improvements minus any depreciation and minus any casualty losses or insurance payments Deductible closing costs include points or prepaid interest on your.

The tax law says that the home mortgage interest deduction must be cut in half in the case of a married person filing an individual return. Called impairment-related work expenses they appear as unreimbursed employee expenses on the Schedule A form used for itemizing. My mother in law has 24-7 home health aides.

Her doctor wrote a note requiring 24-7 care. On your tax returns METC is applicable to certain types of medical equipment drugs hearing and vision aids treatment-related travel renovations to aid or support mobility and more. DogVacay offers 247 customer service and.

Are their costs deductible on her return. What Medical Expenses Are Tax Deductible For 2020. You need to include a detailed statement of the nursing home costs.

Qualified medical expenses paid before death by the decedent arent deductible if paid with a tax-free distribution from any Archer MSA. They keep an up-to-date list of all eligible expenses for the Health Spending Account program. DogVacay is a network of more than 20000 pet sitters across the US and Canada who offer in-home dog-sitting grooming boarding and walking.

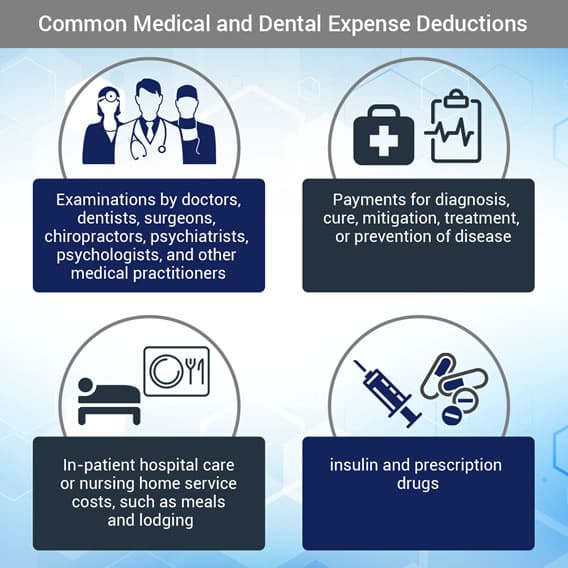

These tend to be exorbitant but fortunately for you some expenses are deductible. Tax Advice Expert Review and TurboTax Live. Certain medical expenses are generally deductible as an itemized deduction on an individuals income tax return.

These are your medical expenses due to the home improvement. Intuit will assign you a tax expert based on availability. Medical expenses change as treatment and technology changes.

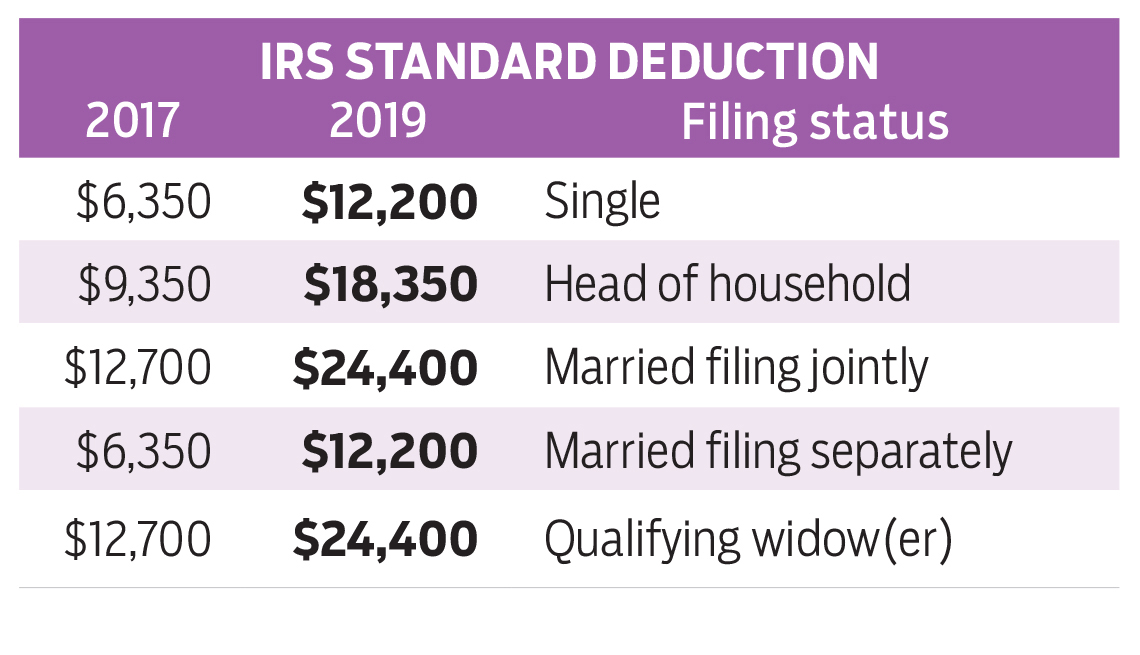

Which assisted living costs are tax deductible. A tax deduction can only be claimed if you paid medical expenses above 7 percent of your income. In order for assisted living expenses to be tax deductible the resident must be considered chronically ill This means a doctor or nurse has certified that the resident either.

If you or your employees have questions about what your Health Spending Account in Canada covers check with the Canada Revenue Agency. How To Apply for the Ontario Trillium Benefit. They are not nurses but do cooking cleaning transportation and keep her safe no unattended falls proper nutrition and assistance in toileting and hygiene.

If the primary reason for entering the nursing home is not to obtain medical care only the portion of the fees directly spent on medical treatment are deductible meals and lodging wouldnt be deductible. Assisted living expenses are. To claim these expenses.

Only the portion of your monthly bill used to pay attendant care salaries can be deducted. There are several advantages of tax deductions. Health insurance or medical insurance also known as medical aid in South Africa is a type of insurance that covers the whole or a part of the risk of a person incurring medical expensesAs with other types of insurance is risk among many individuals.

By estimating the overall risk of health risk and health system expenses over the risk pool an insurer can develop a routine. In other words a married person filing separately can deduct the interest on a maximum of 375000 for a home purchased after December 15 2017 and 500000 for homes purchased before that date. Attendant care costs including those paid to a nursing home can be used as medical expense deductions on your tax return.

The Volunteer Income Tax Assistance VITA program offers free tax help to people who generally make 58000 or less persons with disabilities and limited-English-speaking taxpayers who need help preparing their own tax returns. 11471 Where an individual chooses to claim the limited amount of attendant care expenses provided under paragraph 11822b1 plus the disability tax credit see 135 in respect of an eligible person with a disability who receives full-time care in a nursing home a breakdown of the amounts charged by the nursing home showing the portion for attendant care would be. All bookings are completed via the DogVacay website.

Sitters can earn up to 1000month. This tax credit can also be claimed for your spouse common-law partner and children under 18 years of. Are some of these deductible expenses.

One of these is your medical and dental expenses. The tax code allows you to subtract expenses for things you must have in order to work. Ontario government investments this year are expected to add up to 2000 new nursing school positions and allow hospitals to employ more than 4000 health externs nursing students supervised by nurses who work as unregulated care providers as part of health-care teams.

Requires supervision due to a cognitive impairment such as. Here are few steps to leverage when looking to deduct nursing home costs from your taxes. Cannot perform at least two activities of daily living such as eating toileting transferring bath dressing or continence.

Paid accommodation costs for living in a nursing home. While recruitment strategies are viewed as positive by many in the nursing profession. If possible check expenses before you incur them.

Most individuals are unaware how expansive the term Qualified Medical Expenses are in the tax code. Amounts you pay for operation and upkeep of a capital asset qualify as medical expenses as long as the main reason for them is. Home office occupancy expenses for example rent mortgage interest or rates accommodation and meals unless sleeping away from home for study such as to attend a residential school.

Process for claiming CRA medical expenses. You also need a completed Form T2201. Although most Canadians are aware that the medical expense tax credit exists many fail to keep the necessary receipts or running tally of expenses.

_____ Operation and upkeep. Generally you need to file your tax return for the previous year in order to be considered for the OTB. CPA availability may be limited.

Defining your tax home then becomes the key to determining if you qualify to receive tax-free stipends. Organ transplant reasonable amounts paid to find a compatible donor to arrange the transplant including legal fees and insurance premiums and reasonable travel board and lodging. Phones with braille and audio features and related repairs.

Give To Charity But Don T Count On A Tax Deduction

17 Things You Can T Claim In Your Tax Return Platinum Accounting Taxation

What Are Tax Deductible Medical Expenses The Turbotax Blog

Japan Taxing Wages 2021 Oecd Ilibrary

Private Home Care Services May Be Tax Deductible

Download A Free Expense Report Template From Vertex42 Com For Recording And Reporting Travel Expense Spreadsheet Template Report Template Sales Report Template

What Are Tax Deductible Medical Expenses

Making Home Care Tax Deductible At Home Nursing Care

What Tax Deductions Are Available For Assisted Living Expenses

What To Know About Deductible Medical Expenses E File Com

17 Best Income Tax Saving Schemes Plans In 2022

13 Business Expenses You Definitely Cannot Deduct

5 Most Overlooked Rental Property Tax Deductions Accidental Rental Rental Property Real Estate Rentals Rental Property Management

What Medical Expenses Can I Claim On My Taxes In Canada

What To Know About Deductible Medical Expenses E File Com

Income Tax Exemption And Deductions For Employees Fy 2019 2020

Tax Deductible Medical Expenses In Canada Groupenroll Ca

You Can T Say Corporate Corruption Didn T Have A Good Run With This Deduction Facts Didyouknow Did You Know Turn Ons Facts

Are Assisted Living Expenses Tax Deductible In Canada Ictsd Org